From the Madrid City Council we want to help you and accompany you in your first steps towards entrepreneurship, providing you with the necessary resources and tools so that you can launch your project.

Here we leave the information that every person who wants to get started in the entrepreneurial world should know:

The Law 18/2022, of September 28, on the creation and growth of companies, hereinafter “Create and Grow Law”, aims to promote business agility and growth, reduce obstacles and promote transparency in payments, with specific measures that impact the creation of companies, the fight against late payment, the liberalization of the trade and strengthening business financing.

Among its main novelties are:

Business creation facilitation:

- The constitution of limited companies with a minimum share capital of 1 euro is permitted.

- The electronic creation of companies is promoted through the single window of the electronic system called CIRCE, reducing deadlines and lowering costs

Fight against late payment:

- The creation of a State Observatory of Private Delinquency is promoted to promote transparency in payments and the promotion of good practices.

- The electronic invoice is established as an instrument to reduce transaction costs in commercial traffic and improve access to information on payment terms.

Measures to comply with payment deadlines:

- It is established the obligation of all commercial companies to include in their annual accounts the average payment period to suppliers.

- Companies that wish to receive aid of more than 30,000 euros cannot have invoices pending payment for more than two months.

Trade liberalization:

- The Law on Trade Liberalization Measures is amended, expanding the catalog of license-exempt activities.

Market unit:

- Law 20/2013 guaranteeing market unity is adjusted with clarifications based on accumulated experience and reinforces the protection of operators. These modifications, contemplated in article 6 of Law 18/2022, expand the legitimation capacity, improve transparency and strengthen inter-administrative cooperation mechanisms.

Reinforcement of financing:

- Measures are introduced to improve financing instruments for business growth, including adaptations to the regulation of the crowdfunding.

Other provisions:

- Provisions related to civil societies, benefit and common interest societies, and transitional measures are introduced.

- Existing regulations are reformed, such as:

Additional regulatory deployment:

- Deadlines are established for the adaptation of the standard ordinance for retail commercial activities, among other measures.

- Manual for the development of the business plan. Base guide for the preparation of the business plan that the Madrid City Council makes available to entrepreneurs. It is complemented by the Simulator.

- Business plan simulator. Complementary tool to the Business Plan Manual so that you can enter your project data in the Excel format that is displayed and obtain the final document in PDF format.

- Tool to prepare the business plan. Tool developed by the General Directorate of Industrial Strategy and SMEs (DGEPYME), of the Ministry of Industry and Tourism, which helps prepare the business plan through the Internet, requiring registration. Others are also enabled digital tools to complete the business plan, very useful for entrepreneurs and information on ways of financing.

- Taxation and accounting of businessmen and professionals, individuals. This document prepared by the Tax Agency details all the tax obligations that businessmen and professionals, natural persons, have to comply with.

- Guide to the new Accounting Plan for SMEs. Guide prepared by the Ministry of Industry and Tourism, for the application of the SME General Accounting Plan, which tries to simplify and systematize the information, incorporating examples and exercises, based on the Regulations approved in Royal Decree 151. Modified and updated BOE no. January 26, 30, 2021.

- 2024 Taxpayer Calendar. Prepared by the Tax Agency, aimed at remembering compliance with the main state tax obligations.

For the creation of companies:

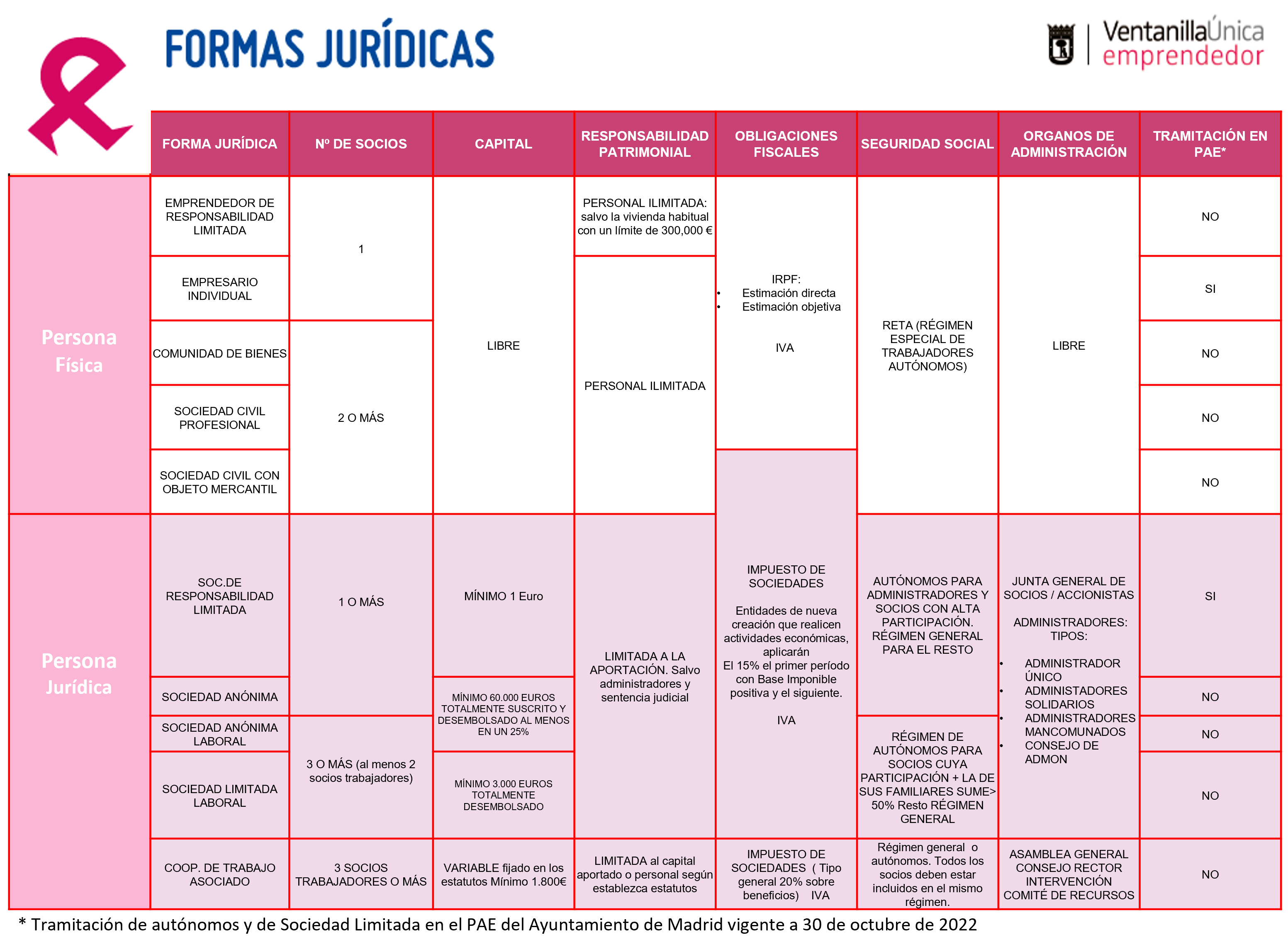

- Choice of legal form. Help tool when choosing the legal form for the company.

- Creation of companies – business creation processes and flow charts according to the chosen legal form (DGEIPYME).

- Company: Creation and start-up

- Individual entrepreneur: Creation and start-up. It is advisable to also consult the Individual Entrepreneur Guide

- Limited Company: Creation and start-up It is advisable to also consult the informative brochure on the procedures necessary for the creation of a Limited Company and the informative brochure that exposes the most common procedures for the start-up and development of the activity. You can also consult the SL telematic processing and the documents necessary to carry it out.

- Community of goods: Creation and implementation

- Civil Society: Creation and implementation

For the dissolution There are two forms of companies depending on the type of legal form:

Read more:

All this information will help you launch your entrepreneurial project, as well as have the necessary tools to achieve success.