Microbank social microcredits

With the aim of promoting self-employment and encouraging entrepreneurial activity, the Madrid City Council has signed an agreement with the financial institution Microbank to support access to financing for the establishment, consolidation or expansion of micro-enterprises, self-employed businesses and self-employment projects .

In addition, especially, a financing line is established aimed at business projects of an innovative nature.

To access these lines of financing it is necessary to provide a business plan and get a favorable feasibility report of the project prepared by Madrid Emprende, as a MicroBank collaborating entity.

Interested entrepreneurs can contact us requesting appointment.

For more information consult the conditions in micro bank

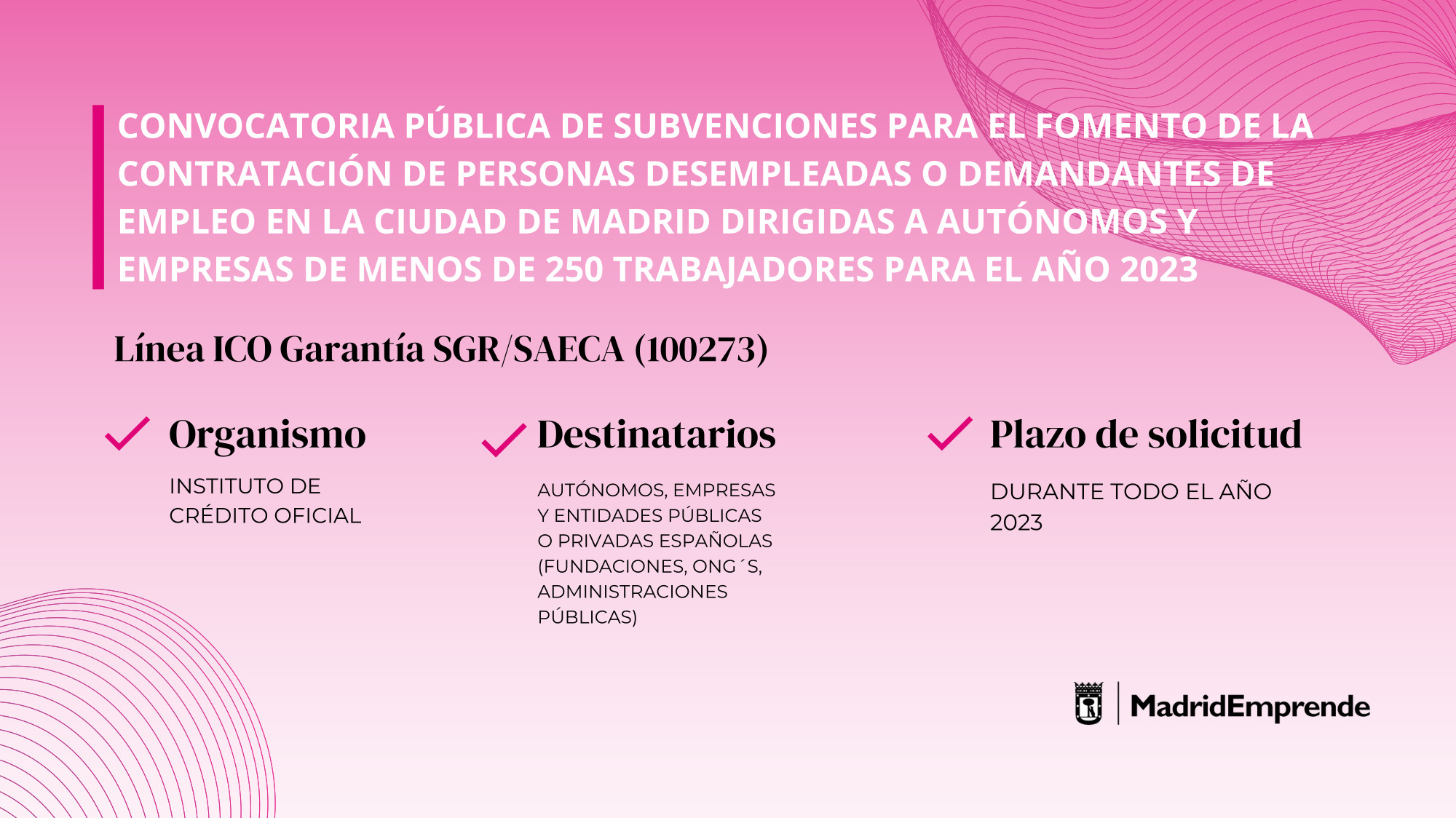

Other financing lines

ICO Companies and Entrepreneurs Lines

What does it finance?

- Investment projects, business activities and/or need for liquidity or expenses.

- Digitization projects and, in particular, those aimed at promoting teleworking solutions included in the program Accelerate SMEs.

- Rehabilitation of houses and buildings.

For whom?

- For freelancers and entrepreneurs.

- Individuals and communities of owners.

More information and other possible lines of financing at: www.ico.es

ENISA lines

ENISA actively participates in the financing of business projects feasible and innovative. Have 5 lines:

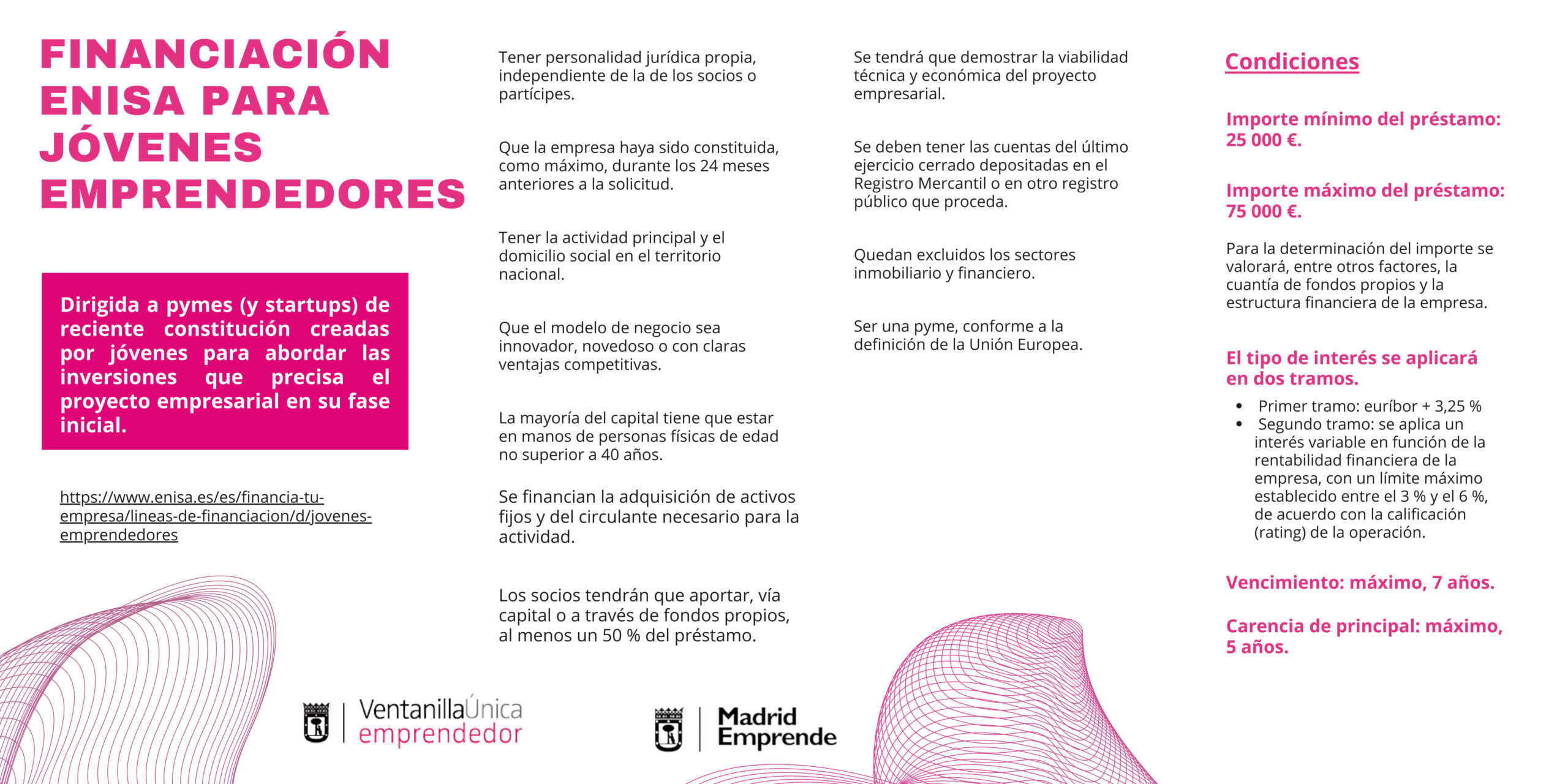

- Young Entrepreneurs. Aimed at young entrepreneurs who want to create companies. Objective: to provide the necessary financial resources to recently established SMEs, created by young people, so that they can undertake the investments required by the project in its initial phase.

- Entrepreneurs. Aimed at entrepreneurs who want to create companies with a clear competitive advantage. Objective: to financially support SMEs promoted by entrepreneurs, without age limits, in the early stages of life, so that they undertake the necessary investments and carry out their project.

- Increase. Aimed at supporting the business projects of companies interested in expanding their business or achieving competitive improvement.

- AgroInnpulse. Aimed at promoting the digital transformation of companies in the agri-food sector and the rural environment.

- Digital Entrepreneurss. Aimed at promoting female digital entrepreneurship.

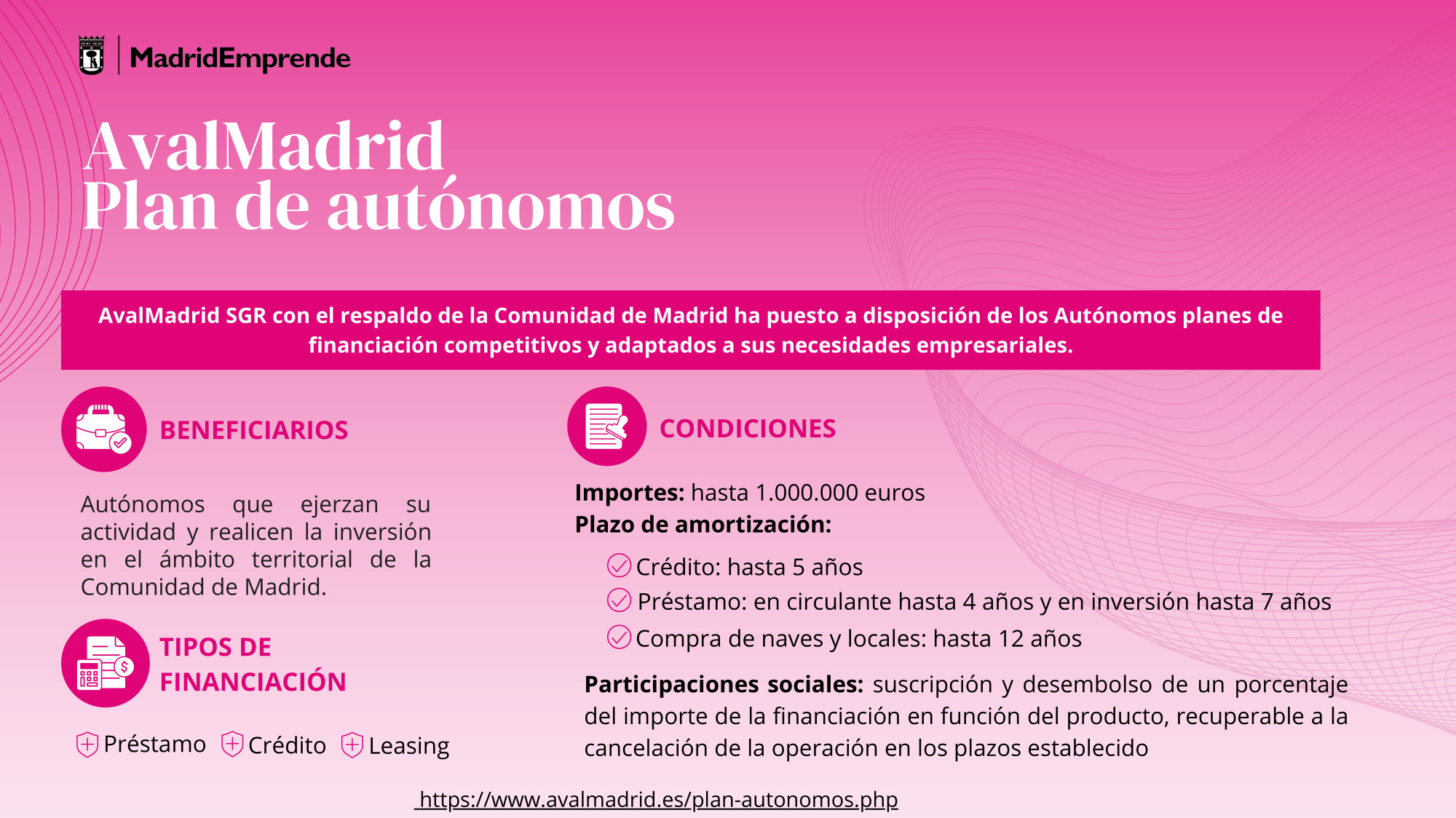

avalmadrid

Financing for SMEs and the self-employed.

Investment: